"The current wave of interest is new enough - and many of the followers young enough - that it has been easy to ignore how the most popular funds have often lagged basic stock indexes and threaten to eat away at long-term returns. Samuel Hartzmark, a professor of finance at Boston College, has researched the issue for more than a decade and has found that investors tend to fall for the "free dividends fallacy," treating them and capital gains as separate."

"A 2015 paper of his finds that investors prone to that bias have a preference for funds that report boosted dividends even if they don't improve overall returns. There is a scrolling chart at the beginning that compares returns with different strategies over time. At first, I wasn't fond of a non-zero baseline on an area chart, but technically it's a difference chart with a baseline that indicates the starting investment. I guess I'll let it slide."

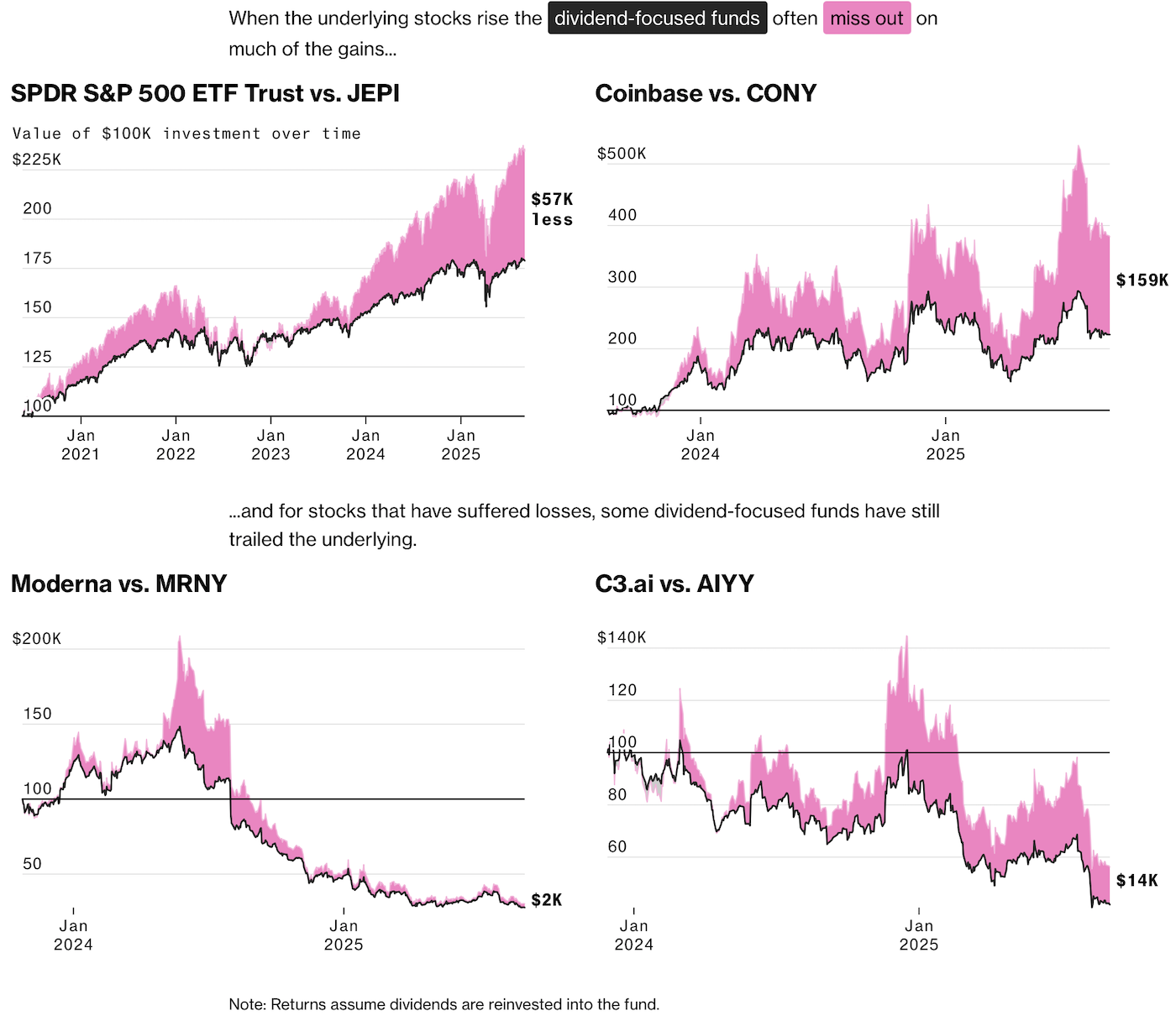

Investors are increasingly allocating capital to high-dividend investments, favoring immediate payouts over long-term capital appreciation. That preference can diminish long-term wealth because many dividend-focused funds lag basic stock indexes and can erode returns over decades. Academic research identifies a behavioral bias called the "free dividends fallacy," in which investors treat dividends and capital gains as separate and therefore favor funds that report larger dividends even when overall returns do not improve. Comparative charts show how dividend-heavy strategies diverge from other approaches over time. Visual design choices, such as baseline selection, can influence perceptions of relative performance.

Read at FlowingData

Unable to calculate read time

Collection

[

|

...

]