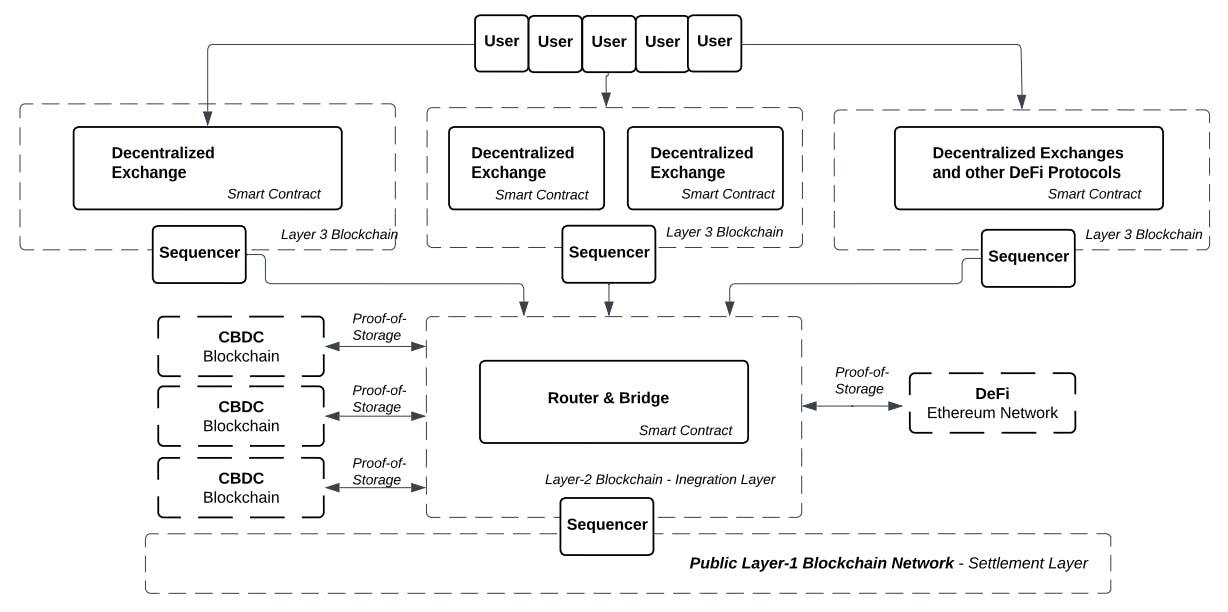

"This paper introduces a novel cross-border CBDCs exchange using a Layer-2 blockchain on a public Layer-1 network, emphasizing security and interoperability."

"The proposed system leverages the existing security of Layer-1 networks and smart contracts facilitated through the Ethereum Virtual Machine for broader DeFi integration."

"Transaction privacy and compliance are prioritized in this system, leveraging KYC protocols and zero-knowledge proofs to navigate regulatory landscapes while ensuring privacy."

"The use of proof-of-storage protocols instead of traditional bridges enhances security, eliminating trust assumptions while allowing for efficient minting of CBDC tokens on Layer-2."

The article presents a new framework for cross-border Central Bank Digital Currency (CBDC) exchanges, utilizing a Layer-2 (L2) blockchain on an underlying public Layer-1 (L1) network such as Bitcoin or Ethereum. It emphasizes the role of central institutions in managing interoperability, and the use of Layer-3 (L3) blockchains for decentralized exchanges. Security and compliance measures, including KYC and zero-knowledge proofs, are highlighted to protect transaction privacy. Additionally, the paper advocates adopting proof-of-storage protocols to ensure security in minting CBDC tokens, improving upon the limitations of traditional cross-chain bridges.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]