#consumer-protection

#consumer-protection

[ follow ]

#ftc-investigation #instacart #dynamic-pricing #cfpb #trump-mobile #false-advertising #meta #journalism-funding

fromBusiness Insider

1 day agoTrump is overhauling student loans, and private lenders are preparing for an influx of borrowers

Sen. Elizabeth Warren and a group of her colleagues released the first congressional analysis of the impact of the coming changes to federal student loans on the private lending market. The report - exclusively viewed by Business Insider - compiled new information provided by six lenders, detailing how they are preparing for an anticipated influx of borrowers into the private market.

Higher education

fromThe Drum

3 days agoRyanair calls on Google to curb sponsored screen-scapers taking its search topspot

Ryanair stated that the scrapers provide shoppers with outdated or inaccurate information (such as little to no mention of Ryanair's infamous hidden charges which are at least outlined in the official website). Furthermore, the customer details are rarely passed onto the airline meaning it cannot contact them if there's any change in the flight manifest.

Marketing tech

fromwww.independent.co.uk

5 days agoBoots and Superdrug accused of misleading shoppers with dodgy' reward card deals

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging. At such a critical moment in US history, we need reporters on the ground.

UK news

Music

fromLos Angeles Times

5 days agoWhy California's fight over ticket fraud has become a proxy war against Ticketmaster and Live Nation

Speculative and fake resale tickets on secondary markets can leave buyers unable to attend events despite payment, revealing gaps in consumer and artist protection.

Soccer (FIFA)

fromAbove the Law

6 days agoFIFA 2026, Politics, And The Law: What Sepp Blatter's Warning Really Means For The World Cup In America - Above the Law

Legal, immigration, security, consumer protection, and tort issues will shape fan access and liability for the 2026 World Cup across three host countries.

Miscellaneous

fromIrish Independent

1 week agoEstimated 500,000 in accidental payments made at 'tipping terminals'

Consumers frequently tip but feel pressured by digital payment methods; regulators urge clearer opt-out options, separation of tipping terminals, and transparent communication of service charges.

fromForbes

1 week agoAI Chatbot Ads Spark Senator's Privacy And Safety Concerns

When OpenAI announced earlier this week that it would begin testing advertisements within ChatGPT, it marked a key shift in how AI tools make money. The company promised users could opt out of personalized ads and would see clear labels distinguishing promotions from regular responses. However, widespread concerns over the use of ads in AI content has many worried. Senator Ed Markey sent a letter this week to OpenAI CEO Sam Altman and other tech leaders expressing concerns over the use of ads with AI.

US politics

fromTime Out New York

1 week agoNYC moves to ban hotel junk fees ahead of World Cup

With the FIFA World Cup set to descend on the region this summer, city officials announced this week that hidden hotel fees and surprise credit card holds will soon be illegal under a new rule finalized by the Department of Consumer and Worker Protection. The measure aims to rein in last-minute add-ons like "resort," "destination" or "service" fees that quietly inflate room rates long after travelers think they've locked in a price.

New York City

fromSun Sentinel

1 week agoProposal to require state oversight of insurance affiliate payments clears first hurdle in Legislature

It found that during that period, 19 insurers based in Florida or surrounding regions funneled billions of dollars in fees to holding companies and other affiliates that were not "fair and reasonable," as defined by various industry rules. The insurers were not identified in the study. The study showed that insurers paid investors $680 million in dividends and accepted $951 million in capital contributions from affiliates, clouding regulators' abilities to determine insurers' actual financial health.

US politics

Marketing tech

fromLondon Business News | Londonlovesbusiness.com

1 week agoInfluencer platforms in the UK: What local brands should look for - London Business News | Londonlovesbusiness.com

Use an influencer platform with UK-ready, end-to-end workflows that enforce disclosure, claims discipline, privacy-safe recruitment, and finance-ready reporting to limit enforcement and reputational risk.

New York City

fromwww.amny.com

1 week agoMAMDANI'S FIRST 100 DAYS: Mayor takes on hotel junk fees,' condemns antisemitism in Brooklyn amNewYork

Zohran Mamdani banned hidden hotel junk fees, condemned antisemitic graffiti in Borough Park, and emphasized affordability priorities on his 21st day in office.

Real estate

fromBoston Condos For Sale Ford Realty

2 weeks agoWill Massachusetts Follow The Trend Of Restricting 'private Listings'? Boston Condos For Sale Ford Realty

Washington's SB 6091 would require privately marketed homes to be concurrently offered publicly, classifying secret listings without public access as an unfair practice.

Miscellaneous

fromEngadget

2 weeks agoItalian regulators are investigating Activision Blizzard's monetization practices

Italian regulator is investigating Activision Blizzard's Diablo Immortal and Call of Duty: Mobile for misleading, aggressive monetization practices, deceptive UI, and permissive parental controls.

fromTechCrunch

3 weeks agoA consumer watchdog issued a warning about Google's AI agent shopping protocol -- Google says she's wrong | TechCrunch

In a now viral post on X viewed nearly 400,000 times, Lindsay Owens on Sunday wrote, "Big/bad news for consumers. Google is out today with an announcement of how they plan to integrate shopping into their AI offerings including search and Gemini. The plan includes 'personalized upselling.' I.e. Analyzing your chat data and using it to overcharge you."

E-Commerce

California

fromTasting Table

4 weeks agoCalifornia Cracks Down On Food Delivery Apps In 2026, With New Protections For Your Money - Tasting Table

California AB 578 requires cash refunds for incorrect or undelivered food-delivery orders, preserves driver gratuities, mandates human customer-service access, and strengthens delivery-worker protections.

fromwww.housingwire.com

4 weeks agoReal Brokerage added as defendant in RESPA suit against Zillow

All of the teams named as defendants advertise on either their social media channels or website that they are part of the Zillow Flex program. Similarly to the two original complaints, the consolidated amended complaint claims that Zillow, and now the real estate defendants, violated a variety of statutes, including the Real Estate Settlement Procedures Act (RESPA), the Washington Consumer Protection Act, the Racketeer Influenced and Corrupt Organizations (RICO) Act and the law of unjust enrichment and fiduciary duty.

Real estate

California

fromThe Mercury News

1 month agoTraffic death of Campbell boy leads to lower speed limit in school zones

California will implement multiple laws improving school-zone safety, elections, consumer protections, workers' rights, and concealed-carry rules, and hosts an agricultural strategic plan webinar.

California

fromwww.mercurynews.com

1 month agoTraffic death of Campbell boy leads to lower speed limit in school zones

California will adopt laws lowering school-zone speeds to 20 mph, speeding ballot counts, protecting consumers and animals, requiring rental price disclosure, and allowing rideshare unionization.

California

fromwww.mercurynews.com

1 month agoNew California laws rewrite car-buying rules with return policy and pricing reforms

California enacted SB766 granting a three-day full-refund right for used vehicles under $50,000, strengthening price and financing disclosure and banning deceptive add-on charges.

fromThe Local France

1 month agoEverything you need to know about the 2026 winter sales in France

France has two government-ordained sales periods, one in summer, one in winter; the rest of the time discounts and special offers shops can offer consumers are strictly limited. While you might be able to get a deal at other times, the best bargains are reserved for the period of les soldes, when retailers are allowed to sell items at below cost price.

France news

New York Islanders

fromwww.amny.com

1 month agoMamdani taps federal trade regulator to lead Department of Consumer and Worker Protection amNewYork

Sam Levine will lead NYC's Department of Consumer and Worker Protection to combat wage theft, labor abuse, employee misclassification, and predatory corporate practices.

fromwww.independent.co.uk

1 month agoWhy drivers could be paying more for fuel than they should

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging. At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

UK news

fromwww.mercurynews.com

1 month agoWhy did Budget wait 18 days to charge me $450 for dirty' floor mats?

Budget should have inspected the van when you returned it and quickly given you a detailed invoice explaining the $450 fee. Budget's own policy states that its cleaning charges will be reasonable (although it reserves the right to determine what is reasonable). California's Consumer Legal Remedies Act also prohibits deceptive claims, including vague fees. You should've taken photos of the van at pickup and return, even if you thought nothing was wrong,

Law

fromwww.npr.org

1 month ago4 common scams to watch out for this holiday season

In a frenzy of last-minute gift shopping and travel bookings, we can be more anxious, more distracted and more vulnerable. "There's a lot of hustle and bustle during the holiday season, so there's a lot more opportunities for scammers to steal from us," says Amy Nofziger, senior director of Fraud Victim Support at the AARP Fraud Watch Network, a fraud prevention service.

Information security

fromwww.independent.co.uk

1 month agoInstacart will pay customers $60 million in settlement over false advertising'

Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging. At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

US politics

fromTelecompetitor

1 month agoDem senators want status quo on broadband labels

The broadband label framework was designed to work like nutrition labels, giving consumers a clear, consistent way to understand what services they are buying before they commit. After years of development and a bipartisan vote to implement these protections, we are now at the point where providers have integrated these labels into their systems and consumers are beginning to rely on them. This is not the moment to reverse course,

US politics

Public health

fromWPXI

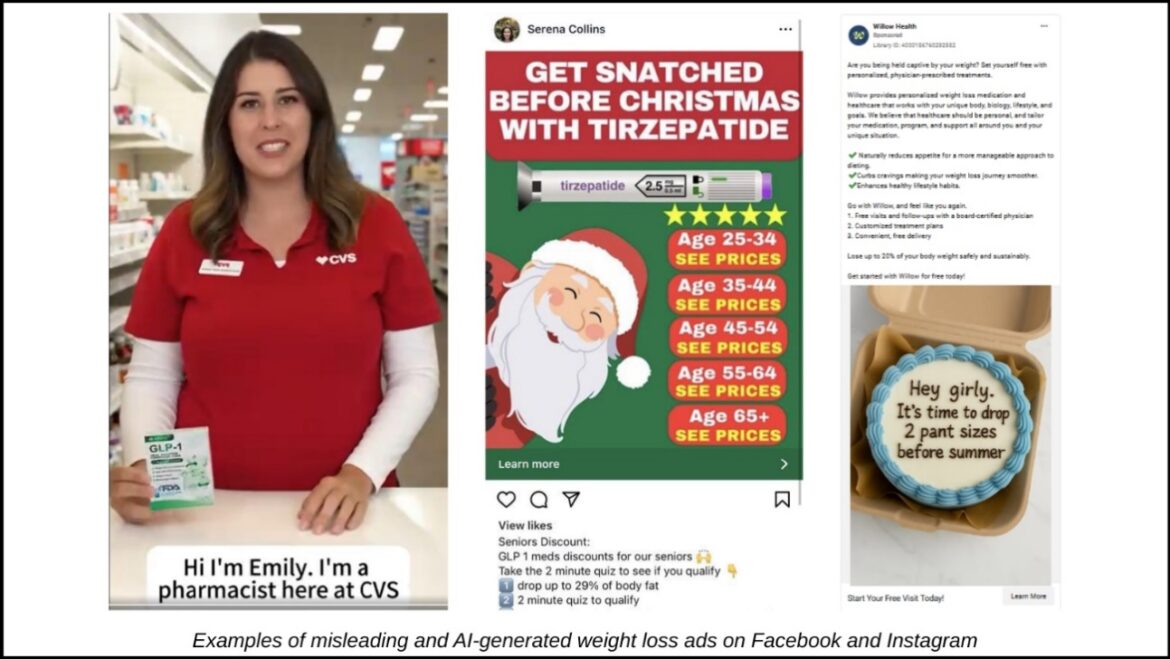

1 month agoPennsylvania attorney general part of crackdown on misleading AI-generated weight loss ads

A bipartisan coalition of 35 attorneys general demands Meta stop deceptive AI-generated weight-loss ads, require clear risk disclosures, and restrict prescription drug promotions.

fromwww.housingwire.com

1 month agoNew York outlaws right-to-list agreements

The property rights of American homeowners must be safeguarded, Caroline Cone, director of state government affairs for the American Land Title Association (ALTA), said in a statement. It is essential to ensure there are no unreasonable restraints on a homeowner's ability to sell or refinance their home in the future due to unwarranted transaction costs. ALTA, along with AARP, were strong proponents of the bill, as well as other similar pieces of legislation across the country.

Real estate

Social media marketing

fromeuronews

1 month agoInfluencer marketing in fast-fashion and food sectors under scrutiny

Influencer marketing often lacks transparency, promotes unhealthy foods, frequently fails to disclose paid partnerships, and may breach consumer law, prompting calls for joint liability and restrictions.

[ Load more ]