"By the numbers: Wall Street projects that AI capex will reach 94% of operating cash flow (minus dividends and buybacks) through 2026, according to Bank of America. That's up from 76% in 2024, showing how fast AI investments are ballooning. Since the ratio is still below 100%, companies technically don't need to issue debt to fund spending, but "they're getting close," BofA notes. That may help explain the burst of AI-fueled borrowing in September and October, led by Oracle and Meta."

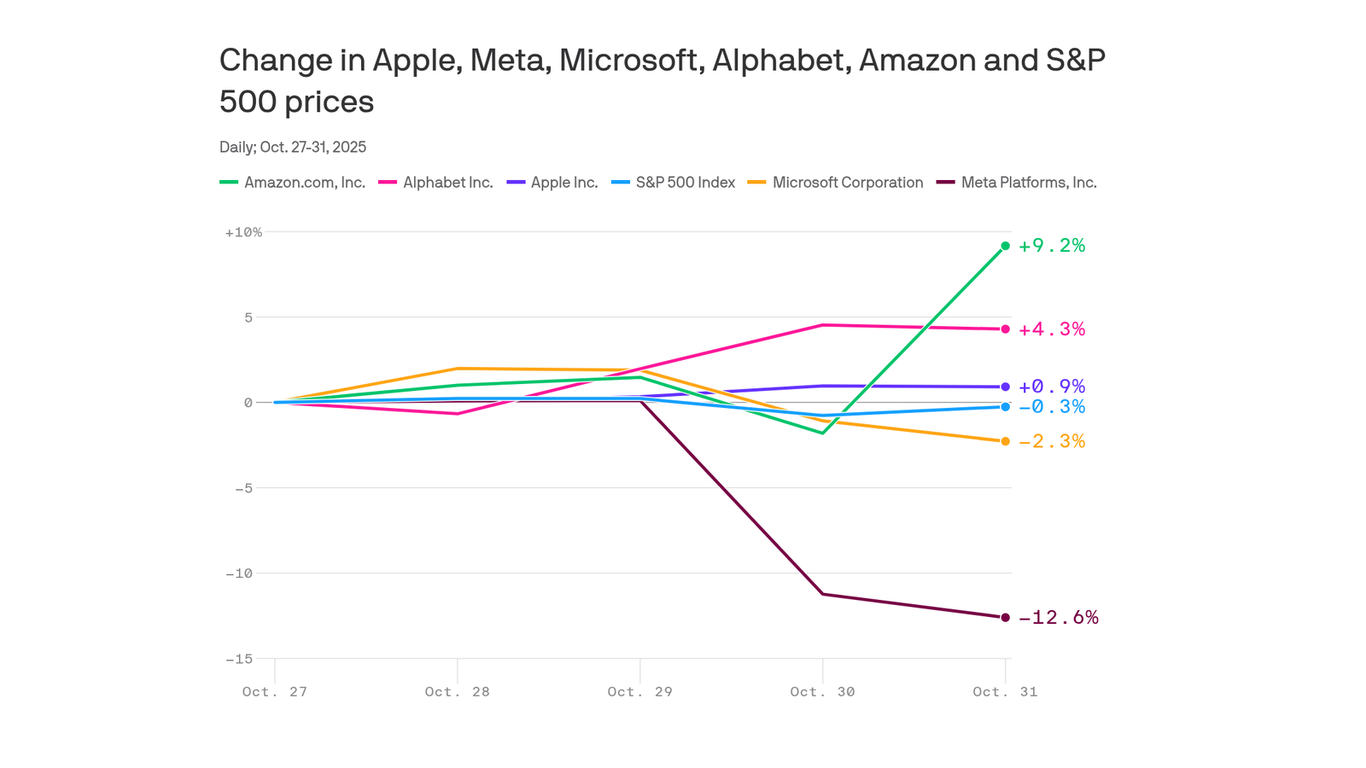

"All these companies are spending big on AI, but only Meta got dinged for it. Why? Its ratio of capex to revenue is the lowest among the Mag 7. Investors enjoyed Meta's "year of efficiency" in 2023 and may feel as if Meta CEO Mark Zuckerberg is "treating shareholders cash as if its his cash," Gil Luria, managing director at the investment firm D.A. Davidson, tells Axios. Zuckerberg may argue that the stakes of AI are high enough to warrant a ramp in spending."

Demand for AI infrastructure, tools and power is exceeding supply, directly driving increased corporate spending. Major tech firms detailed AI investment rationales: Meta and Google linked AI to higher ad revenue, Microsoft reported strong demand for AI cloud tools, and Apple previewed an AI-enabled Siri for 2026 while maintaining strong hardware sales. Bank of America projects AI capital expenditures will reach 94% of operating cash flow through 2026, up from 76% in 2024, edging close to levels that might require debt. Several companies borrowed in September and October to finance AI projects. Overbuilding remains a central risk.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]