"Revenue reached $3.03 billion, up 31% sequentially and 61% year-over-year from $1.88 billion. Non-GAAP earnings hit $6.20 per share, significantly beating the consensus estimates. GAAP net income soared to $803 million, a 672% increase from $104 million a year ago; gross margins expanded to 51.1%, reflecting higher pricing and a favorable product mix; and free cash flow jumped over 1,000% year-over-year."

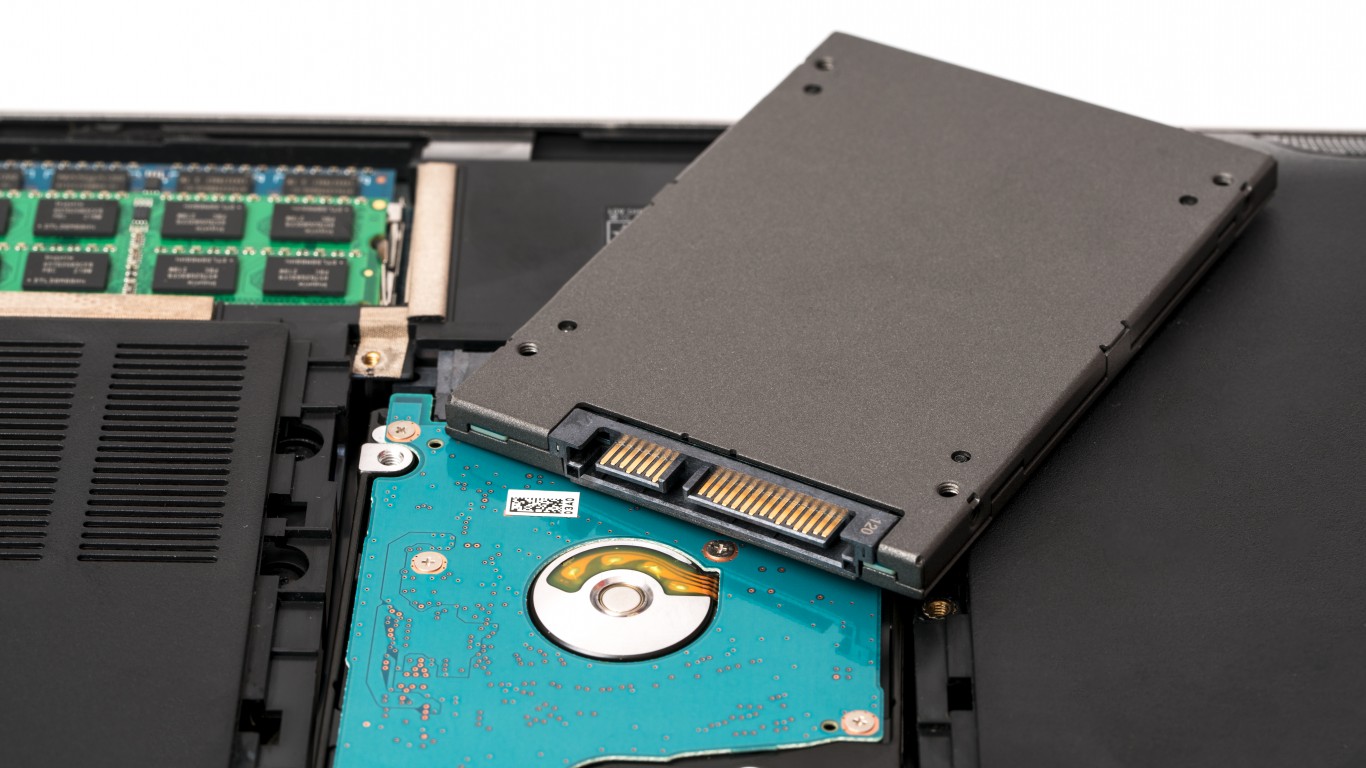

"The growth stems from explosive demand for NAND flash and enterprise SSDs in AI infrastructure. Data center revenue climbed 64% sequentially to $440 million, driven by AI builders and hyperscalers. Edge revenue grew 63% year-over-year to $1.68 billion, while consumer revenue rose 52% to $907 million. Tight NAND supplies amid accelerating demand pushed average selling prices up in the mid-30% range."

"In the 12 months since, its stock has soared 1,479% amid surging demand for flash memory products. Shares are climbing another 14% this morning to around $659, after a Wall Street analyst raised his price target on Sandisk stock from $580 to $1,000 per share, citing its robust growth prospects. With AI fueling relentless storage needs, is there any stopping Sandisk's momentum?"

Sandisk delivered a commanding fiscal second-quarter performance with $3.03 billion in revenue, up 61% year-over-year, and non-GAAP EPS of $6.20. GAAP net income rose to $803 million, gross margins expanded to 51.1%, and free cash flow jumped over 1,000% year-over-year. Data center revenue climbed 64% sequentially to $440 million, edge revenue increased 63% to $1.68 billion, and consumer revenue grew 52% to $907 million. Tight NAND supplies lifted average selling prices substantially. Third-quarter guidance calls for $4.4–$4.8 billion revenue and $12–$14 non-GAAP EPS with margins forecast at 65%–67%.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]