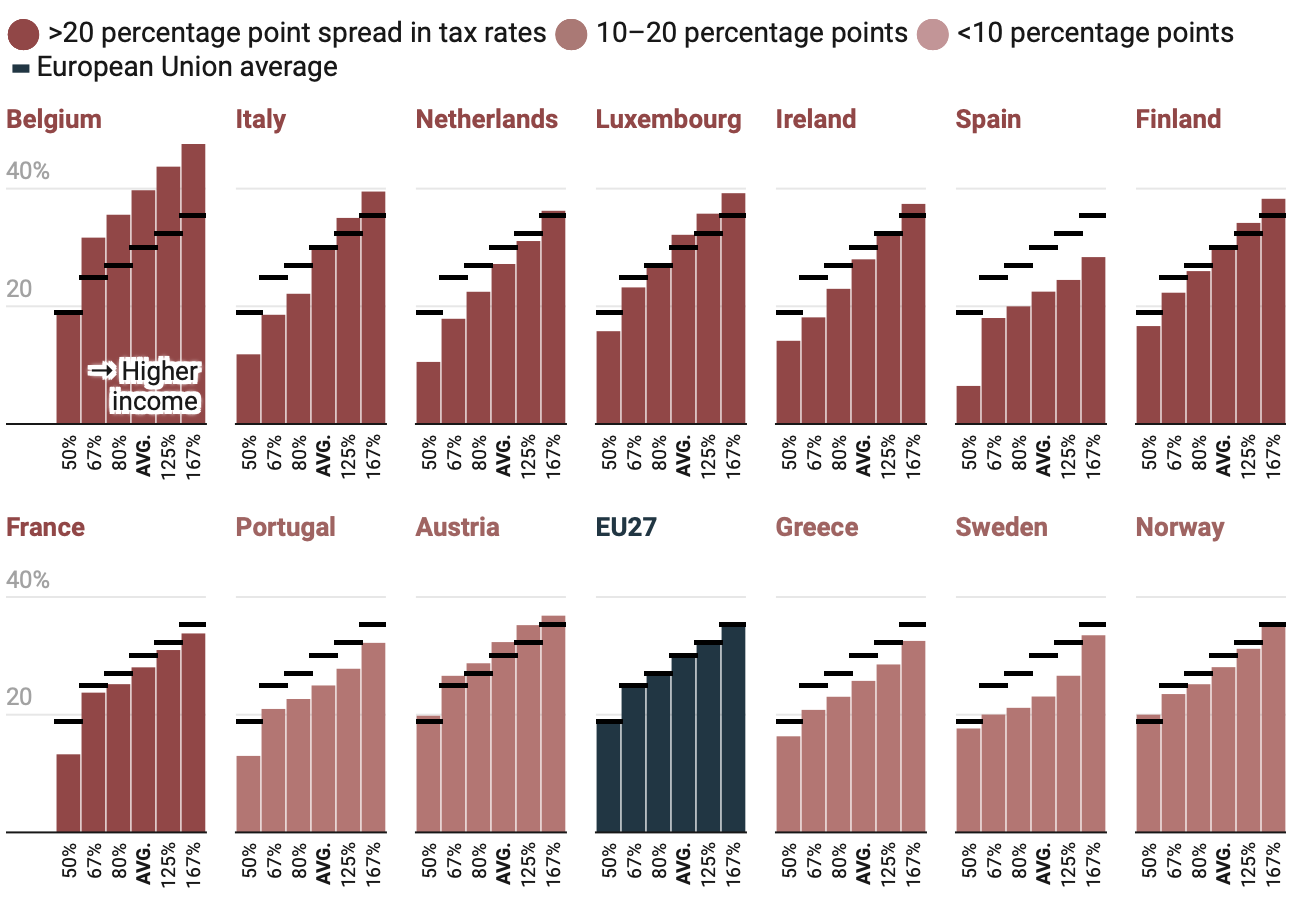

"In comparing income tax systems, Belgium stands out with a sharply progressive rate structure, taxing higher incomes significantly more than lower ones, contrasting with countries like Hungary that apply a flat tax rate."

"The Datawrapper chart illustrates the distinctive approaches to income taxation across Western European countries, highlighting Belgium's progressive framework versus the flat tax models of Hungary and Bulgaria."

The article discusses the varying tax rates in Western Europe, focusing primarily on income taxation. Luc Guillemot's chart for Datawrapper clearly illustrates how different countries approach taxation based on income levels. In this visual representation, Belgium is highlighted as having the steepest progressive tax rate structure, applying higher taxes on increased income. Conversely, countries like Hungary and Bulgaria implement flat tax rates across all income levels, showcasing a significant contrast in fiscal policy among European Union nations.

Read at FlowingData

Unable to calculate read time

Collection

[

|

...

]