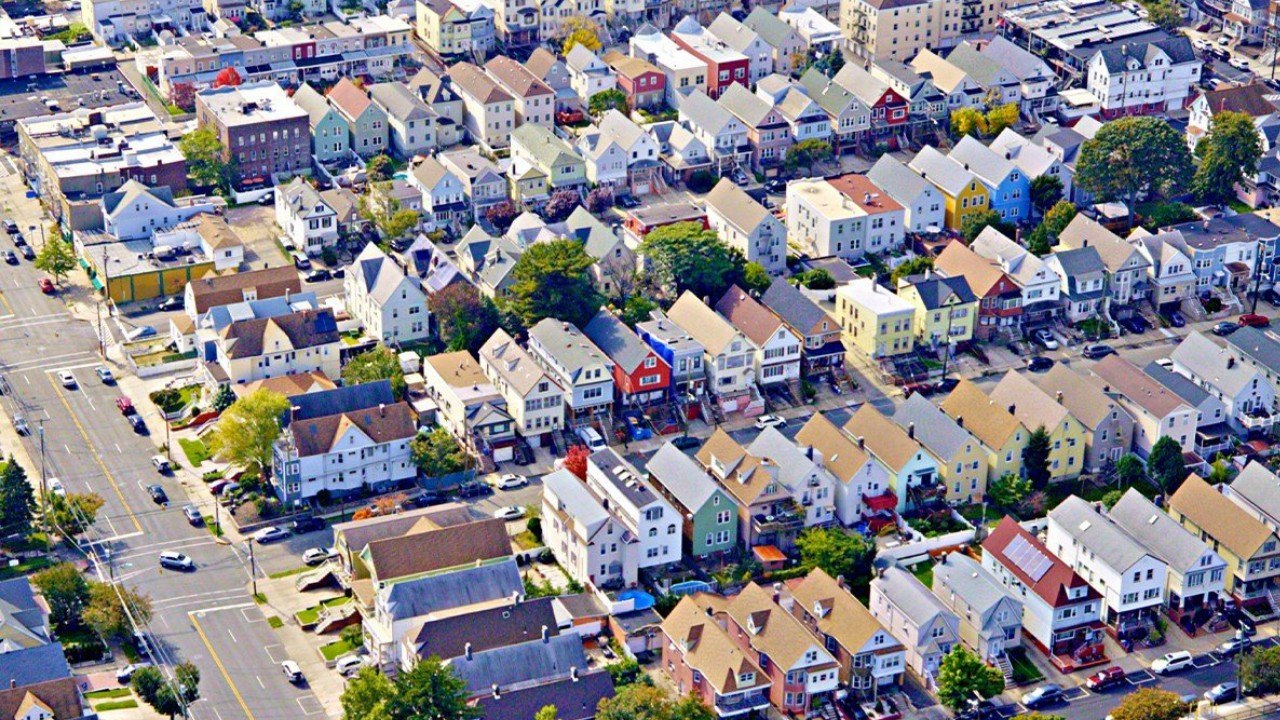

"Homeowners in New Jersey face significant tax bills due to home equity exceeding the IRS capital gains exclusion limits. 46.2% exceed $250,000 and 12.7% exceed $500,000."

"The capital gains exclusion has not changed since 1997, leading to millions facing unexpected tax liabilities due to rising home prices, which have increased by over 260%."

"New Jersey's high capital gains tax rates, topping out at 10.75%, further compound the tax burden for longtime homeowners selling in today's market."

"The 'stay-put' penalty is affecting the Northeast, where homeowners are hesitant to sell out of fear of significant capital gains taxes, limiting market supply."

In New Jersey, 46.2% of homeowners have more equity than allowed for capital gains tax exclusions, with 12.7% exceeding the $500,000 threshold for joint filers. The capital gains exclusion levels have not changed since 1997, despite home prices rising over 260% nationwide, leading to unexpected tax liabilities. New Jersey taxes capital gains as income, reaching up to 10.75%, adding to the financial burden when selling homes. This has created a "stay-put penalty," where long-term homeowners avoid selling to evade significant taxes, constraining market dynamics.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]