"Donald Trump’s new tax bill is projected to add $4.1 trillion to the national debt due to significant tax cuts and funding allocations, resulting in 10 million Americans losing health insurance by 2034."

"The Congressional Budget Office analysis highlights that major cuts to Medicaid and food stamps will save $1.1 trillion, but this amount pales in comparison to the estimated $4.5 trillion in lost revenue."

"The tax cuts included in the bill make permanent the reductions initially introduced in the 2017 tax bill, such as cutting the corporate tax rate from 35% to 21%."

"Maya MacGuineas noted that the economic benefits of the new tax bill are likely to be modest or negative, with no credible estimates predicting an improvement in the financial situation."

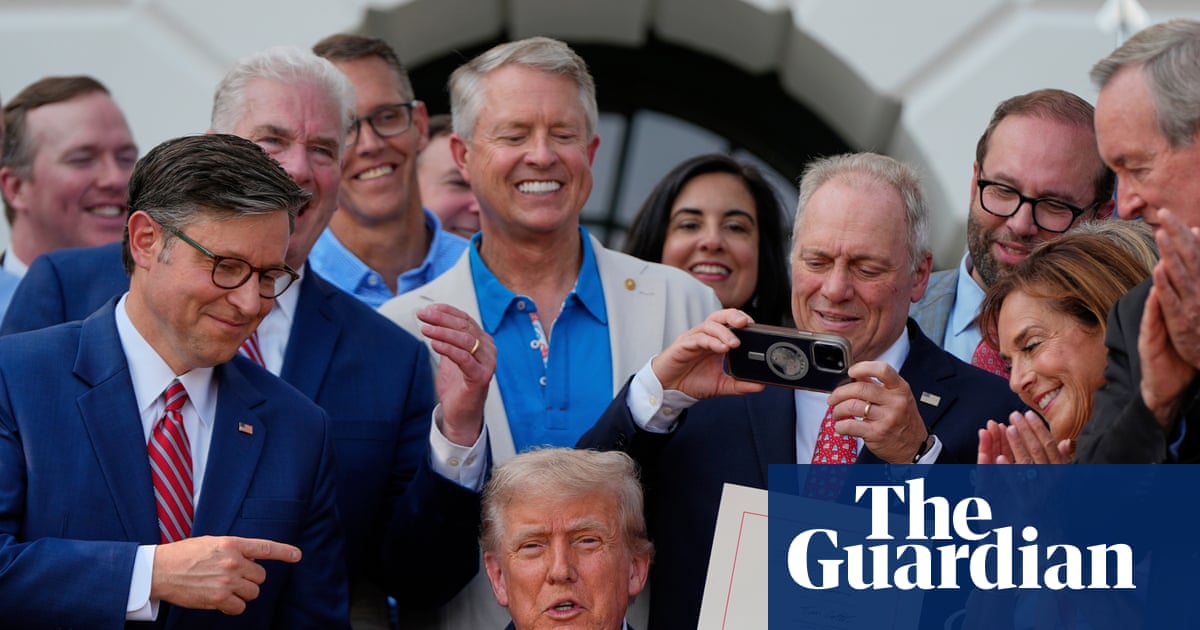

The new tax bill signed by Donald Trump is expected to increase the national debt by $3.4 trillion within the next decade, according to the Congressional Budget Office. Major cuts to Medicaid and the national food stamps program may save approximately $1.1 trillion, yet this does not offset the $4.5 trillion in revenue losses from the tax cuts. This legislation will also lead to 10 million Americans lacking health insurance by 2034, while allocating funds to immigration enforcement and making certain tax cuts permanent. The overall impact on the deficit may reach $4.1 trillion with interest considered.

Read at www.theguardian.com

Unable to calculate read time

Collection

[

|

...

]