"Nearly half of DIY investors (48%) said their investments dropped in value and 57% of Baby Boomers have had their investments drop in value, compared to 43% of Gen Z, 47% of Millennials and 49% of Gen X."

"30% have been anxious/worried about the market, whilst 27% of men have been anxious or worried about the market, compared to 33% of women."

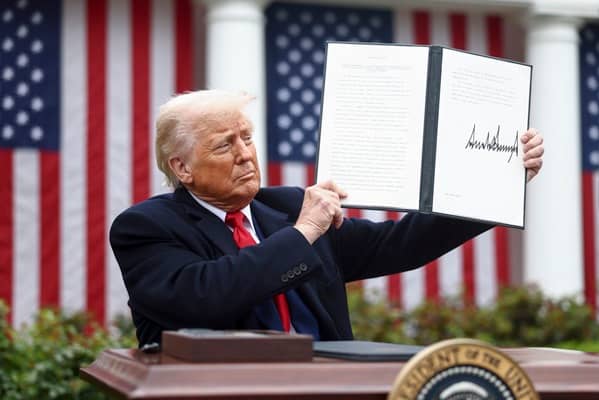

"Rob Morgan, Chief Investment Analyst at Charles Stanley Direct, said, 'With universal tariffs paused once again, this allows an additional grace period for investors to ensure their portfolios.'"

"On average, DIY investors think it will take 5.8 months for the finances to recover from the impact of Trump's tariff announcement."

Trump's tariffs initially caused significant disruption in global markets and supply chains, negatively affecting individual investment portfolios and pensions. A study found that nearly half of DIY investors experienced decreases in their investments, with Baby Boomers most affected. While there was a temporary pause in tariffs, concerns remain as the deadline for their reimplementation approaches in August 2025. Many investors express anxiety, particularly Millennials. Investors are encouraged to consult financial advisers on strategies to recover losses, with estimates suggesting a recovery timeframe of about 5.8 months for finances.

Read at London Business News | Londonlovesbusiness.com

Unable to calculate read time

Collection

[

|

...

]