""Unless the China stuff gets really ugly, I think the market will treat these as minor hiccups and potential buy the dips," Stuart Kaiser, head of U.S. equity strategy at Citi, told Axios."

"Annual S&P 500 revenue from China sits at $1.2 trillion, Apollo chief economist Torsten Sløk told Axios."

"The cost of goods sold rose over 15% from 2015 to 2019, in part due to the implementation of tariffs in President Trump's first term."

"Several market sources told Axios that investors should expect volatility off tariff headlines, but any dips are buyable, barring bad news about China."

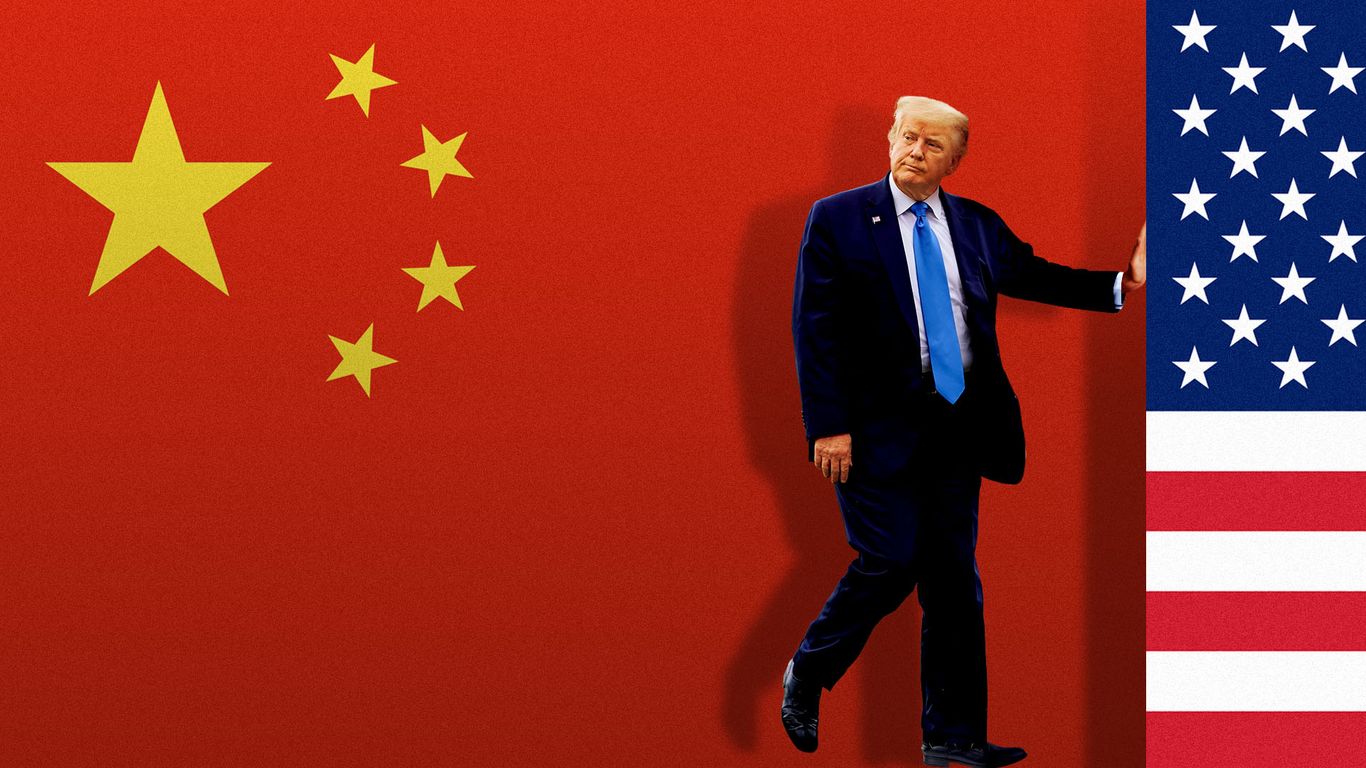

The U.S.-China trade relationship significantly impacts market conditions, especially with U.S. companies relying on China for both supply and demand. The tariff rates on China are critical, as the S&P 500 earns $1.2 trillion from the region. The implementation of tariffs since 2015 has resulted in over a 15% increase in costs, pressuring profits and stock prices. Experts suggest that while volatility from tariff-related news is expected, investors should consider dips as buying opportunities, unless serious issues arise with China.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]