#meme-stocks

#meme-stocks

[ follow ]

#stock-market #short-squeeze #beyond-meat #gamestop #retail-trading #opendoor #retail-investors #volatility

from24/7 Wall St.

1 week ago3 ETFs Seeing Record Redemptions As Investors Rush For The Exits

Over the last few years, the market has seen a number of trends that have led to huge market moves. Apart from AI, which is the main impetus to the jet fueled "Magnificent 7" tech stocks leading the S&P 500 and still going strong, some of the booms that became busts in the latter part of 2025 going into January 2026 are: ETFs with extreme leverage Ultra high yield ETFs using options for income

Business

from24/7 Wall St.

3 months agoGME vs. AMC: Which Fallen Meme Stock Could Spike Once Again?

Though I wouldn't look to punch a ticket at these levels, I certainly wouldn't dare initiate a short position. Indeed, if the meme frenzy of 2021 taught us anything, it's that betting against even a seemingly sure thing is a dangerous proposition that might just lead to uncapped losses. Between going long and going short, I'd much rather go for the former any day of the week.

Business

from24/7 Wall St.

4 months agoUp Another 11%, Here's Why Rigetti Computing Just Can't Stop Winning

( Rigetti ComputingNASDAQ:RGTI) has become a quantum computing poster child, soaring from obscurity to a $10 billion valuation in mere years. As quantum tech inches closer to practical applications - things like drug discovery or unbreakable encryption - RGTI's stock has caught fire. Over the past month, shares have more than doubled, climbing from below $15 to over $31 per share. This isn't just about tech progress; it's also meme stock mania.

Startup companies

from24/7 Wall St.

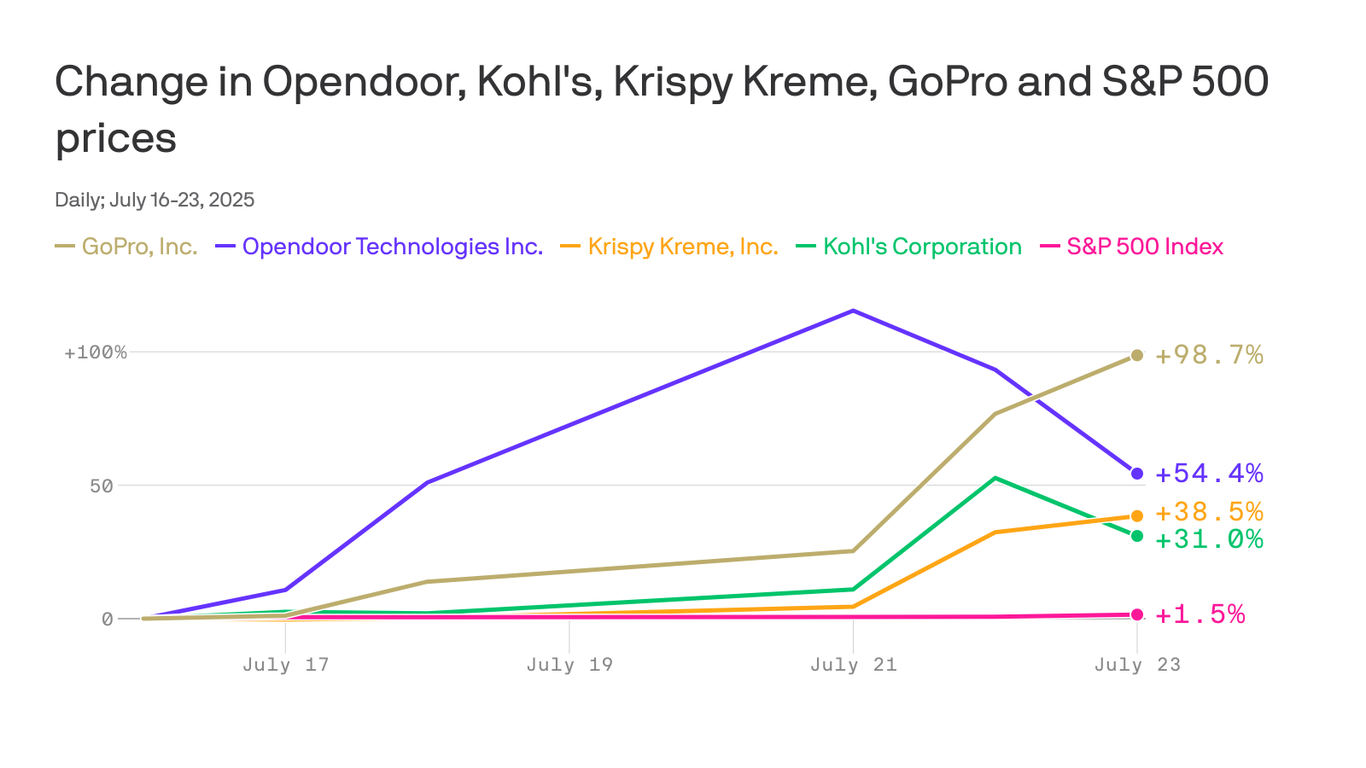

4 months agoMeme Stock Traders Abandon Opendoor Technologies for Better Homes & Finance

Here we go again. Meme stock traders, those fickle thrill-seekers of the market, have found a new love interest after ditching their summer fling with Opendoor Technologies ( NASDAQ:OPEN ). The spark was hedge fund manager Eric Jackson of EMJ CapitaBetter Home & Finance Holding ( l anointing NASDAQ:BETR ) as "the Shopify of mortgages." Jackson's declaration lit a fire under BETR stock, sending shares surging 47% on Monday and rallying another 33% higher in noontime trading today.

Business

from24/7 Wall St.

6 months agoForget GME: Krispy Kreme (DNUT) Is the New Meme Stock

The stocks are usually a target of short sellers or those who bet against the stock. With the rising momentum, other investors join and start buying to boost the price, which prompts others betting against the stock to buy more to cover losses.

Miscellaneous

[ Load more ]