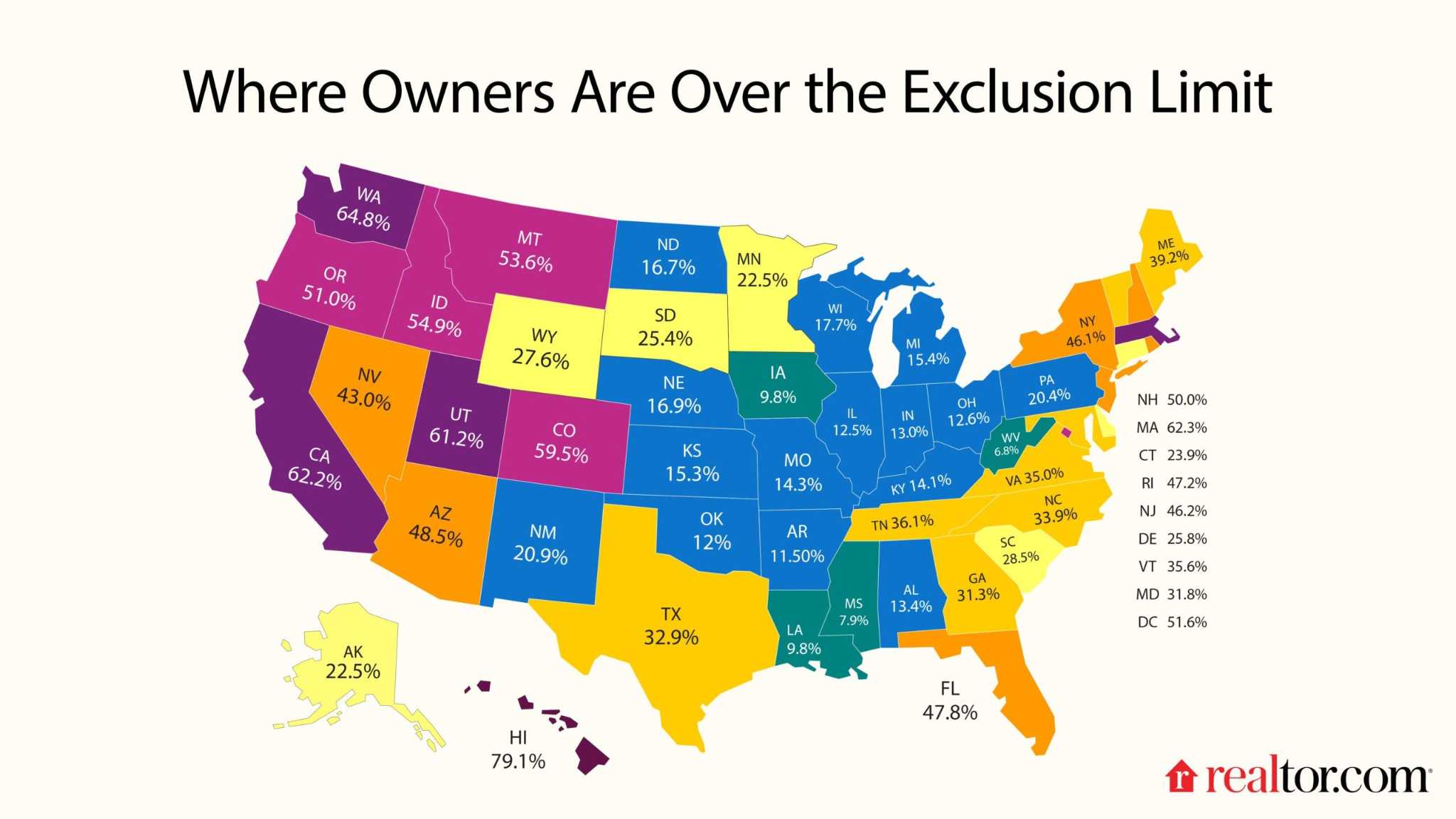

"Roughly 1 in 3 homeowners in America has built up more equity than the federal capital gains tax exclusion for single filers protects, meaning nearly 29 million households could face a tax of up to 20%."

"Greene introduced the No Tax on Home Sales Act, a bill aimed at eliminating the federal capital gains tax on the sale of a primary residence, framing it as a gift for American homeowners."

"Greene believes the capital gains tax is one of the biggest disincentives to selling homes and intends for the bill to free up inventory by alleviating homeowner fears of substantial tax bills."

"31% of homeowners aged 65 and older exceed the $250,000 exclusion limit for single filers, facing an average potential tax bill of $41,232."

Approximately one-third of American homeowners have equity that exceeds the federal capital gains tax exclusion for single filers, potentially subjecting them to a 20% tax upon sale. U.S. Rep. Marjorie Taylor Greene has introduced the No Tax on Home Sales Act to eliminate this tax for primary residences. Greene views the tax as an unfair penalty on homeowners, particularly affecting retirees and empty nesters. Data shows that 31% of homeowners aged 65 and older surpass the exclusion limit, facing significant tax liabilities on their equity.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]