#housing-market

#housing-market

[ follow ]

fromFortune

20 hours agoThe housing market, workers, and the economy are all stuck | Fortune

The number of U.S. homes that typically change hands as people relocate for work, retire or trade-up for more living space hasn't been this low in nearly 30 years. About 28 out of every 1,000 homes changed hands between January and September, the lowest U.S. home turnover rate going back to at least the 1990s, according to an analysis by Redfin.

Real estate

Real estate

fromFast Company

1 day agoHousing market inventory shift: 17 states where buyers are winning back power

Rising active listings and months-of-supply boost buyer leverage and signal potential home price softness, while inventories below pre-pandemic levels support more resilient price growth.

fromThe Local France

2 days agoAirbnb present across vast majority of French villages and towns

Using data from Airbnb, the study found that 81 percent of French municipalities have at least one accommodation available for rent on Airbnb. In comparison, only 15.6 percent of municipalities have a hotel. In municipalities with fewer than 500 inhabitants, only five percent have a hotel, but more than two-thirds of them have at least one accommodation listed on Airbnb.

France news

Los Angeles

fromtherealdeal.com

1 week agoFrustrated by slow rebuilding approvals, Malibu owners opt to sell

Permitting delays in Malibu have stalled post-fire rebuilding, with only five permits issued versus hundreds in neighboring jurisdictions, slowing reconstruction and depressing the housing market.

Real estate

fromFortune

1 week agoFlorida's housing market was skewed wildly by the pandemic. It's finally coming to grips with a 'realistic middle ground' | Fortune

Florida housing inventory fell for the first time in 110 weeks because of rampant delistings and fewer new listings, not revived buyer demand.

fromsfist.com

2 weeks agoAI Companies Now Disrupting' SF Rental Market By Giving People Free Apartments, Rent Stipends

We've known for several months now that San Francisco has the fastest-rising rents in the country, and that the sharp rent increases are because of the AI boom. But the New York Times has a new analysis of how AI companies are gaming the rental market in their employees' favor, in some cases with $1,000-a-month rent stipends, or in other cases, simply paying the employees' rent for them out of the company's VC-rich coffers.

San Francisco

US politics

fromwww.independent.co.uk

2 weeks agoFantasy economics': Readers warn of housing chaos if stamp duty is scrapped

Abolishing stamp duty divides opinion: critics say it would inflate house prices, hurt first-time buyers, and mainly benefit the wealthy; alternatives include exemptions, rebates, and a mansion tax.

fromLondon Business News | Londonlovesbusiness.com

2 weeks agoThe BSA are 'very concerned' Reeves is 'still considering cuts to the Cash ISA limits'

Cash ISAs are not idle money. They meet real and practical needs, helping people to build financial resilience, save for a house deposit or manage their finances in retirement. They also provide the foundation for future investing and supplying essential funding for mortgages and other lending. The BSA's analysis suggests that a cut in the annual Cash ISA limit from £20,000 to £5,000 could lead to 17,000 fewer mortgage loans and reduce GDP by around £7 billion over five years, undermining economic growth and tax revenues.

Real estate

fromwww.independent.co.uk

2 weeks agoFresh fears for homeowners and buyers as mortgage rates creep back up

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

Media industry

Real estate

fromFortune

3 weeks agoAmerica's real estate is aging in place, just like its population. Investors and CEOs can't ignore it | Fortune

A portion of U.S. real estate is becoming obsolete as demographic shifts and changing needs leave buildings unable to create value for occupants and investors.

fromFortune

3 weeks agoNearly 70% of Americans think the economy is on the 'wrong track' and it's a bad time to buy a home, Fannie Mae survey shows | Fortune

A growing sense of economic pessimism is taking hold in the U.S., as new Fannie Mae survey data reveals nearly 70% of Americans believe the economy is headed in the wrong direction. An even higher percentage (73%) say it's a bad time to buy a house. Coupled with mounting concerns about the housing market, the findings underscore the challenges facing would-be homebuyers, and paint an increasingly bleak picture for consumer sentiment as autumn begins.

Business

Boston Red Sox

fromBoston Condos For Sale Ford Realty

4 weeks agoThe Divide Between A Buyer And Sellers' Market Boston Condos For Sale Ford Realty

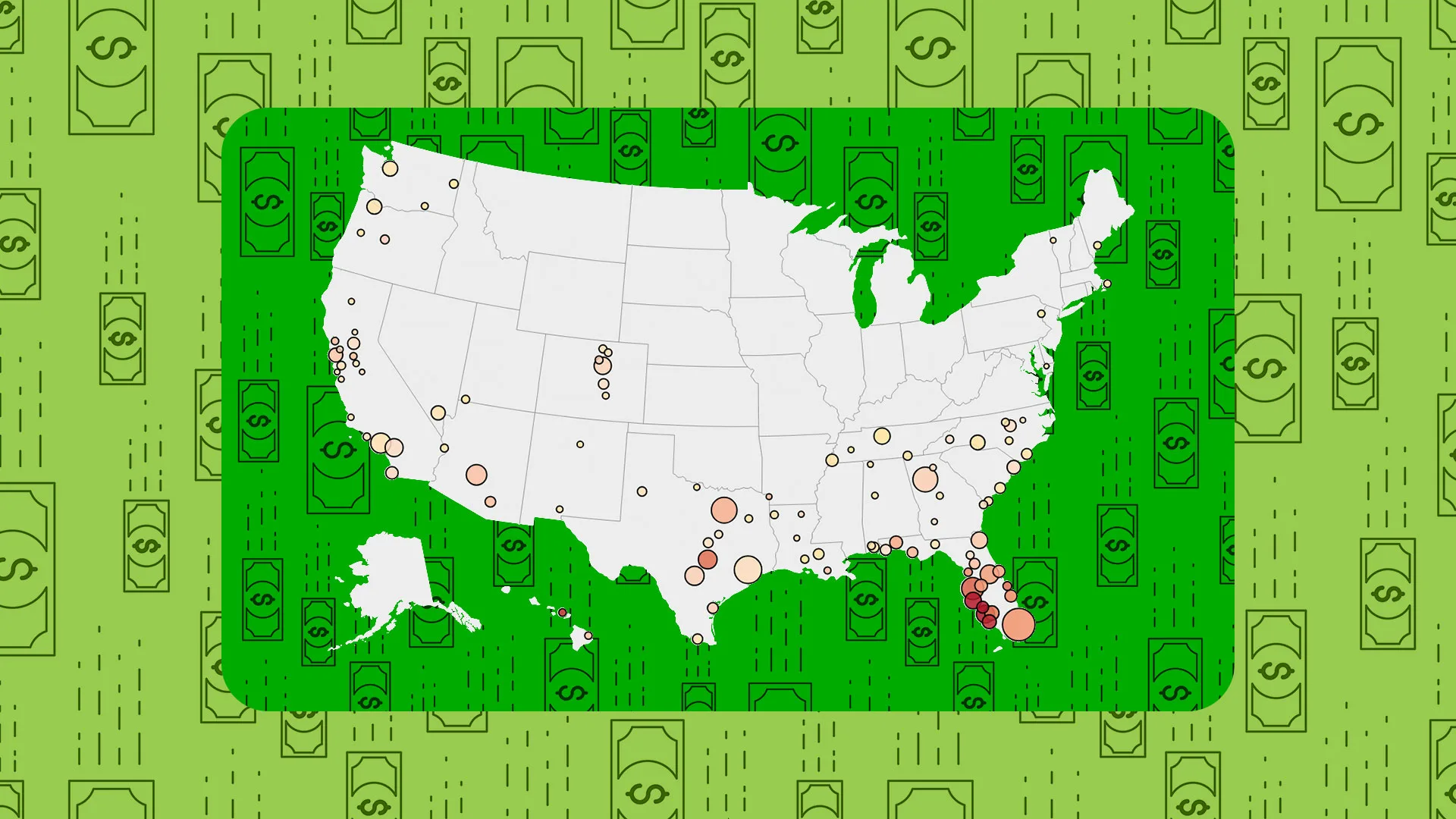

Regional U.S. housing markets diverged: high pandemic construction areas face buyer's markets, while low-build regions remain seller's markets with tight inventory.

fromwww.npr.org

1 month agoCompass-Anywhere real estate merger could squeeze small brokerages

"We have a unique opportunity to utilize the incredible breadth of talent across our companies, especially our world-class agents and franchisees, to deliver even more value to home buyers and home sellers across every phase of the home buying and home selling experience,"

Real estate

fromSFGATE

1 month agoCondo vs. Townhouse: 5 Key Takeaways for Maximizing Equity

Condos and townhouses are often considered more affordable alternatives to single-family homes, offering lower price points, reduced maintenance, and easier entry into homeownership. However, the long-term wealth potential of these property types varies based on location and market forces. Over the past decade, both condos and townhouses have shown significant equity gains, with subtle differences reflecting the evolving housing landscape driven by affordability challenges.

Real estate

fromFast Company

1 month agoThis week in business: From recalls to resurrections (and an unraptured Tuesday)

If you spent the week doomscrolling #RaptureTok and wondering whether to leave your houseplants a goodbye note, good news: the end times did not arrive on Tuesday. What did show up, however, were a bunch of very earthly headlines. One very famous network host is back (though not on every station-because why make anything simple in 2025?). Housing kept playing hot-and-cold depending on your ZIP code, retail nostalgia made a crafty comeback, and beverage brands learned that promising better guts requires better evidence.

E-Commerce

fromFortune

1 month agoYour boomer parents are probably living in a house too big for them. They're frozen in place because of taxes, top economists say | Fortune

Recent analysis from Moody's Analytics, led by Chief Economist Mark Zandi and Deputy Chief Economist Cristian deRitis, points directly to outdated capital gains tax caps as the culprit that is keeping millions of homes off the market and out of reach for families who need them most. According to the report, the problem starts with too many empty-nest seniors "locked in" to homes that no longer fit their needs. But instead of selling and downsizing to a smaller home, the prospect of steep capital gains taxes keeps them in their bigger homes.

Real estate

fromSFGATE

1 month agoIRS Adjusts Tax Brackets for 2026: 5 Key Takeaways

As the housing market shifts toward favoring buyers, there are significant factors at play that may impact first-time homebuyers positively. The anticipated inflation adjustments to the IRS tax brackets for 2026 could potentially provide buyers with more financial leverage, making homeownership more attainable.

Real estate

fromwww.housingwire.com

1 month agoU.S. existing-home sales dip 0.2% in August

While summer is traditionally considered peak season for home-buying, Q4 emerged as the most active period last year, driven by declining mortgage rates in Q3, Waugh said in a statement. Buyers and sellers entering the market now through the end of the year are highly motivated. Navigating seasonal changes such as school schedules, inclement weather, and holiday commitments shows serious intent. Waugh noted that sellers who are keeping their homes ready for showings remain dedicated, even as mortgage rates hit their lowest point of the year and improved affordability draws more buyers back into the market.

Real estate

fromGamintraveler

1 month ago10 Things No One Tells You About Living In Portugal

Portugal has rapidly climbed the ranks of global dream destinations for expats, retirees, and digital nomads seeking sun, surf, historic charm, and an affordable European lifestyle. Its laid-back pace, beautiful coastlines, and relatively low cost of living make it appear like the perfect place to build a new life abroad. However, behind the Instagram-perfect images of tiled streets and sunset wine pours lie realities that few newcomers anticipate before arriving.

Digital life

fromFast Company

1 month agoZillow update rates 250 housing markets as buyer's or seller's markets

Zillow economists use an economic model known as the Zillow Market Heat Index to gauge the competitiveness of housing markets across the country. This model looks at key indicators-including home-price changes, inventory levels, and days on the market-to generate a score showing whether a market favors sellers or buyers. Higher scores point to hotter, seller-friendly metro housing markets. Lower scores signal cooler markets where buyers hold more negotiating power.

Real estate

fromSFGATE

1 month agoCuyahoga Falls, OH Homeowners Can Expect a Cool and Dry Fall, Says The Old Farmer's Almanac

The Old Farmer's Almanac has released its 2025 fall forecast, and for Cuyahoga Falls, OH, cooler-than-usual days are ahead. While much of the western U.S. will feel warmer-than-normal, the Northeast, Great Lakes, and Ohio Valley regions-including northeast Ohio-are in for a brisker, drier autumn. While a cool down is headed for the area, the suburb is still enjoying being dubbed a hot market after landing one the Realtor.com® 2025 Hottest ZIP Codes list.

Real estate

fromSFGATE

1 month agoSheboygan, WI Homeowners Can Expect a Cool and Dry Fall, Says The Old Farmer's Almanac

The Old Farmer's Almanac has released its Fall 2025 weather outlook, and for the Midwest, the season is shaping up to be brisk and dry. While much of the western U.S. will see warmer-than-average conditions, Wisconsin-including Sheboygan-will cool down early and stay that way. At the same time, Sheboygan is making housing headlines: the city has landed among 50 Hottest ZIP Codes of 2025 according to Realtor.com®, a signal that buyers are finding strong appeal in this lakeside market.

Real estate

Real estate

fromFortune

1 month agoThe average American homeowner lost $9,200 in home equity during the last year. It's not a collapse but a 'long-term market correction' | Fortune

U.S. home equity growth has plateaued due to slowing prices, higher borrowing costs, and supply imbalances, trimming recent homeowner equity gains.

fromwww.housingwire.com

1 month agoHousing starts plummet 8.5% in August: Builder confidence wanes amid market challenges

Builders also sought out fewer permits in August, with the seasonally adjusted annual rate falling to 1.312 million, down 3.7% from July and 11.1% annually. Both single family (856,000 units) and multi-family (403,000 units), reported declines, including 11.5% and 10.5% annual declines, respectively. Building permits are now at the lowest level since May 2020, during the height of the pandemic. To meet demand, the nation needs around 2 million new homes a year. Right now, building permits are an anemic 1.3 million, Heather Long, the chief economist at Navy Federal Credit Union, said in a statement.

Real estate

fromwww.housingwire.com

1 month agoMortgage applications soar 29.7% as rates hit 11-month low

Indicative of the weakening job market, and in anticipation of a rate cut from the Federal Reserve, mortgage rates last week dropped to their lowest level since last October, with the 30-year fixed rate declining to 6.39%. Homeowners responded swiftly, with refinance application volume jumping almost 60% compared to the prior week, Mike Fratantoni, MBA's senior vice president and chief economist, said in a statement.

Real estate

[ Load more ]