#mortgage-rates

#mortgage-rates

[ follow ]

#housing-market #housing-affordability #federal-reserve #federal-reserve-policy #home-prices #affordability

from24/7 Wall St.

17 hours agoDave Ramsey Tells 57-Year-Old Investing $2,800 Monthly to Cut Retirement Contributions in Half

A 57-year-old woman and her 68-year-old husband were doing everything right by conventional standards - investing 35% of their take-home pay into retirement accounts. But this aggressive retirement strategy created an unexpected problem: they couldn't save enough for a down payment on their first home. On a January 2026 episode of The Dave Ramsey Show, the couple received counterintuitive advice that challenged standard financial wisdom.

Real estate

fromBusiness Insider

18 hours agoWe bought a house in the city with a 2.75% mortgage rate. After a few years, we feel trapped and want out.

It had everything we wanted as twentysomethings in the city - convenience, charm, great views. Over time, however, our needs have changed, and it's no longer the right fit for us. The only problem? We bought it shortly after the start of the COVID-19 pandemic, when rates had plummeted to historic lows. In fact, we locked in a 2.75% mortgage rate - so now we feel trapped in a house that no longer checks all our boxes.

Real estate

fromwww.housingwire.com

1 week agoRocket CFO forecasts stronger mortgage market in 2026

If you look at the mortgage forecasts, it depends on which one you choose, but they're up anywhere from 8% to 25% based on the Fannie Mae and MBA numbers, Brown said during a webinar with Fitch Ratings. That would be very good for this industry. Brown said 2025 ultimately resembled 2024, although conditions improved in the latter half of the year as inventory increased and mortgage rates eased, but not as much as some of us would like.

Business

fromBoston Condos For Sale Ford Realty

1 week agoAre Americans Moving Less Frequently? Boston Condos For Sale Ford Realty

Regional Concentration: Most relocations now occur within the same region rather than across the country. Households are increasingly "trading one nearby city for another" to find better housing affordability without leaving their home state or region. Proximity to Home: Over 50% of moves stay within the same county, and approximately 80% remain within the same state. Long-distance interstate moves accounted for only about 19.3% of all relocations in 2024-2025.

Real estate

fromwww.housingwire.com

1 week agoPending home sales fell sharply in December

According to Yun, interpreting in-person home search activity for December poses some unique challenges with people traveling and taking time off for the holidays, as well as the challenges posed by winter weather in some markets. We'll be watching the data in the coming months to determine whether the soft contract signings were a one-month aberration or the start of an underlying trend, Yun said.

Real estate

fromwww.housingwire.com

1 week agoRefinance demand soars 20% after rates dropped last week

Mortgage rates declined further last week, driving another big week for refinance applications, which saw the strongest level of activity since September 2025. The 30-year fixed rate averaged 6.16%, the lowest rate since September 2024, said Joel Kan, MBA's vice president and deputy chief economist. These lower rates prompted greater refinance activity from conventional and VA refinance borrowers, with increases of 29% and 26%, respectively. Refinance applications accounted for more than 60% of applications, and the average loan size also moved higher.

Real estate

fromFortune

2 weeks agoIf you want to be financially independent at a young age, don't buy a house, serial investor says. Home ownership is just an 'expensive indulgence' | Fortune

Collins, the best-selling author of Pathfinders and The Simple Path to Wealth, said the reasoning is simple: Buying a home "dramtically inflate[s]" your cost of living. While your mortgage payment and rent payment may be similar on paper, owning a home ends up costing more in the long run and comes with unexpected expenses-often referred to as the "hidden costs" of homeownership, like insurance, repairs, and updates.

Real estate

fromwww.mediaite.com

2 weeks agoTrump Attacks CNN In Friday Night Social Media Spree Even As He Basks In Their Praise

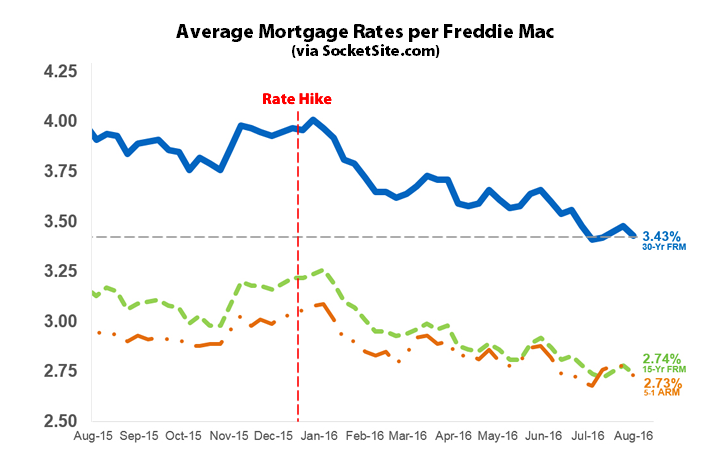

KEILAR: Some encouraging news today for the real estate market. Mortgage rates have now fallen to their lowest level in more than three years, and industry experts hope that it will help break the stalemate that has kept reluctant sellers from selling and would-be buyers from buying. CNN's Vanessa Yurkevich is with us now on this. All right, Vanessa, how low are we talking? VANESSA YURKEVICH, CNN BUSINESS & POLITICS CORRESPONDENT: Yes, we're talking about the lowest level in more than three years. So, the average rate for a mortgage, according to Freddie Mac this week, 6.06 percent.

US politics

fromwww.housingwire.com

3 weeks agoLower mortgage rates support steady new home sales

Sales of new single-family houses in October 2025 were at a seasonally-adjusted annual rate of 737,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.1 percent (14.2 percent)* below the September 2025 rate of 738,000, and is 18.7 percent (21.7 percent)* above the October 2024 rate of 621,000. There were some negative revisions to the past three months, but the trend still stayed positive.

Real estate

fromwww.housingwire.com

3 weeks agoDecember jobs data continues to support lower mortgage rates

Jobs Friday came and went without much reaction in bond yields because the labor market isn't breaking, nor is it getting stronger. Mortgage rates dropped into the 5s for a short time on Friday as a result of Trump's earlier announcement directing the GSEs to buy $200 billion in mortgage backed securities. The 10-year yield didn't move much after the report.

Real estate

Boston real estate

fromBoston Condos For Sale Ford Realty

3 weeks ago6.2% Vs. 7%: Will It Move The Needle For Boston Condo Buyers? Boston Condos For Sale Ford Realty

A decline from 7% to 6.2% will boost Boston condo buyers' purchasing power and demand but will not resolve the underlying affordability crisis.

fromwww.housingwire.com

3 weeks agoModest jobs gains in December signal even cooler labor market

Sectors that showed notable job gains in December include food services and drinking places (+27,000 jobs), health care (+34,000 jobs) and social assistance (+17,000 jobs). On the other end of the spectrum, the retail trade sector lost 25,000 jobs in December. Residential building construction lost 4,200 jobs in December, although employment for residential specialty trade contractors rose by 1,100 jobs. The real estate sector also posted a small increase, adding 2,300 jobs in December.

Real estate

fromwww.housingwire.com

3 weeks agoTrump directs GSEs to buy $200B in mortgage bonds to lower rates

Combined holdings at Fannie Mae and Freddie Mac grew at a 77% annualized pace over the six months ending in November 2025, rising by more than $68 billion to approximately $247 billion. There remains room for further expansion. Under the Preferred Stock Purchase Agreement (PSPA), each GSE's retained portfolio is capped at $250 billion, with an additional $225 billion limit imposed by the Federal Housing Finance Agency (FHFA) under a prior director.

US politics

fromBusiness Insider

3 weeks agoThese 10 cities top the list for first-time homebuyers in 2026

In its analysis, the firm said it screened more than 10,000 Census-designated places in the largest 100 metro areas of the country, and chose from cities that had at least 500 active home listings in the last year. Its ranking also considered factors like housing availability, whether the city had a community of young people, the average estimated commute time, and affordability, which was weighted as one of the most important factors in Realtor.com's analysis.

Real estate

fromKqed

4 weeks agoAdjustable-Rate Mortgages Caused Trouble in 2008. They're Worrying Experts Again | KQED

As the country reemerged from the coronavirus pandemic lockdown in 2021- when the COVID vaccine finally arrived, TikTok reached 1 billion downloads and Adele finally released new music - the housing market also saw its own interesting development. That year, banks offered some of the lowest interest rates seen in over a decade for a type of housing loan known as an adjustable-rate mortgage.

Real estate

fromwww.housingwire.com

1 month agoLogan Mohtashami's 2026 housing forecast

The reason mortgage rates are near yearly lows as we end the year is that the labor market has softened and mortgage spreads have returned to near-normal levels. Without these two variables, mortgage rates would have stayed higher for longer. My 2026 forecast is for the 10-year yield to range between 3.80% and 4.60%, and for mortgage rates to range from 5.75% to 6.75%.

Real estate

Real estate

fromwww.housingwire.com

1 month agoBank statement loans: More mortgage options for self-employed buyers and homeowners as rates ease

Bank statement loans let self-employed or commission-based borrowers qualify for mortgages using 12–24 months of bank deposits and cash-flow documentation instead of W-2s.

fromwww.housingwire.com

1 month agoMortgage applications fall 5% despite rate decline

Overall mortgage application volume fell last week, despite the slight decline in mortgage rates, said Mike Fratantoni, MBA's SVP and chief economist. MBA expects the trends of a softening job market, sticky inflation, elevated home inventories and steady mortgage rates will persist into the new year. Added Fratantoni, Purchase application volume last week was 16% higher than a year earlier. We are forecasting continued, modest growth in terms of home sales in 2026.

Real estate

[ Load more ]