"Many housing markets remain far tighter than the national average, particularly in the Northeast, where active inventory is still significantly below pre-pandemic levels."

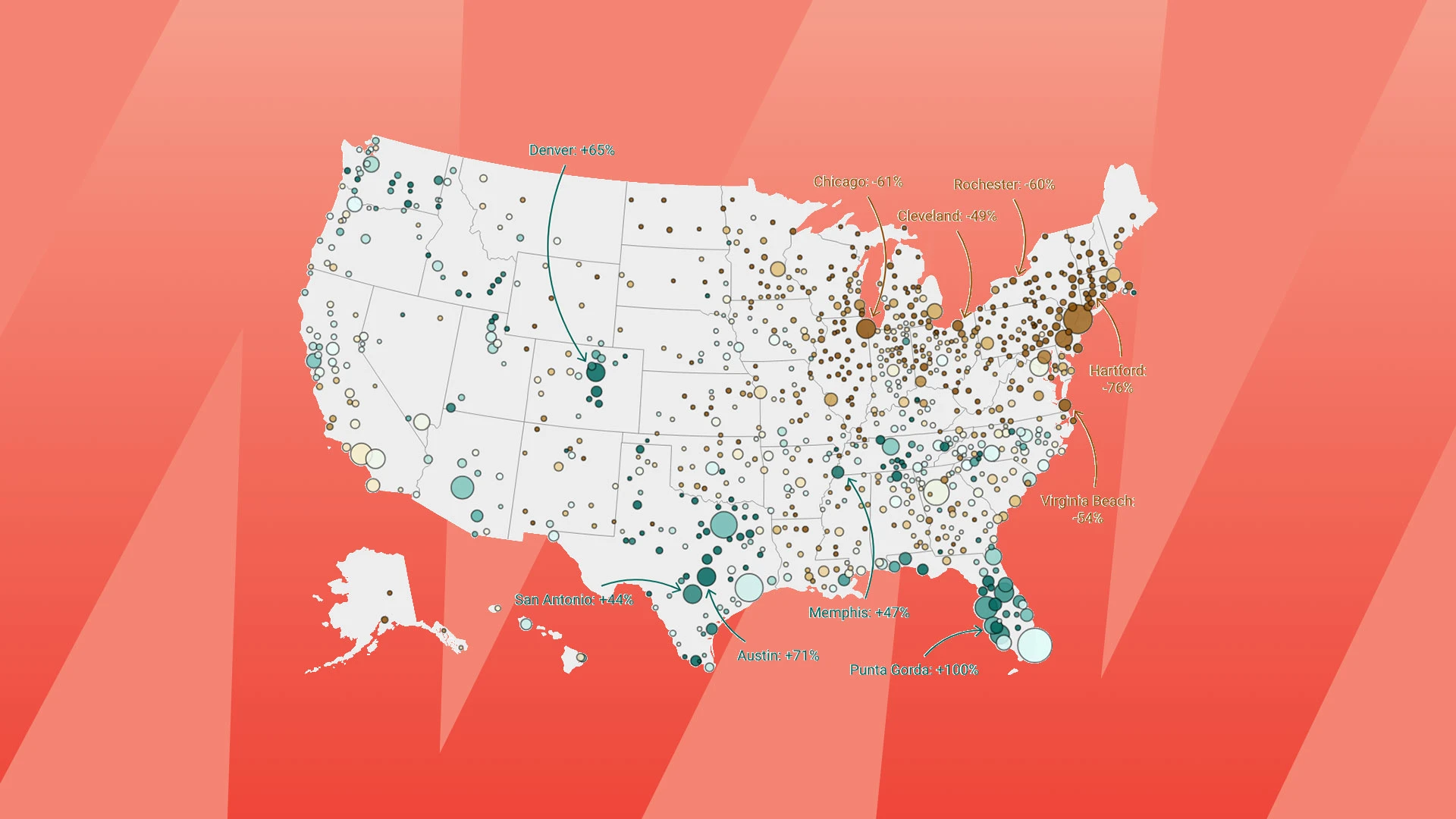

"The national active housing inventory for sale at the end of June was up 29% compared to June 2024, but still 12% below pre-pandemic levels."

"Conversely, housing markets where inventory remains far below pre-pandemic levels have experienced more resilient home price growth over the past 36 months."

"Many housing markets in the Northeast and Midwest are less reliant on pandemic-era migration and have fewer new home construction projects in progress."

National housing inventory at the end of June 2024 rose 29% from the previous year, reaching levels that are still 12% below those of June 2019. While some areas, especially in the Sun Belt, have inventory exceeding pre-pandemic levels leading to weaker price growth, Northeast and Midwest markets remain tighter. These regions have seen less reliance on pandemic migration and fewer home construction projects, maintaining seller advantages. As of May, a significant number of major markets had 50% less active inventory than in June 2019, although this trend is slowly changing.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]