""A 30-year fixed-rate mortgage of 6% would make the median-priced home affordable for about 5.5 million more households-including 1.6 million renters.""

""Many of my clients tell me the same thing: They want to buy, but they feel that mortgage rates are holding them back.""

""Buyer activity was similarly constrained a year ago when rates were roughly the same as today. However, buyer demand today appears even more suppressed.""

""Rates could dip to that projected homebuying sweet spot of 6% by 2026; that would drive home sales up by 14%.""

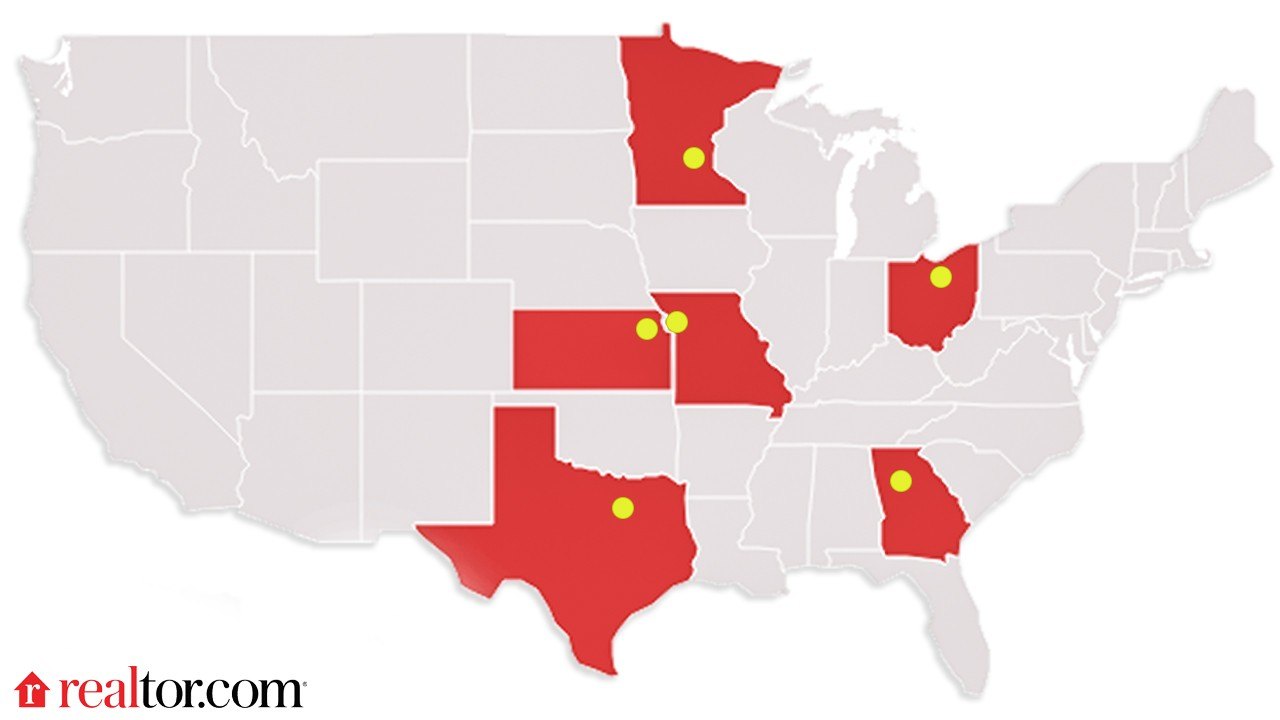

Homeownership is increasingly unaffordable for many Americans due to high prices and mortgage rates around 7%. Unsold homes, including those under contract, have increased by 20% compared to last year. If mortgage rates fell to 6%, about 5.5 million additional households could afford median-priced homes, with an estimated 550,000 potentially buying in the following 12 to 18 months. Current buyer demand is weaker than last year, with many hesitant due to fears of making poor financial decisions. A forecasted drop in rates by 2026 could increase home sales by 14%.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]