#central-bank-reserves

#central-bank-reserves

[ follow ]

US news

fromFortune

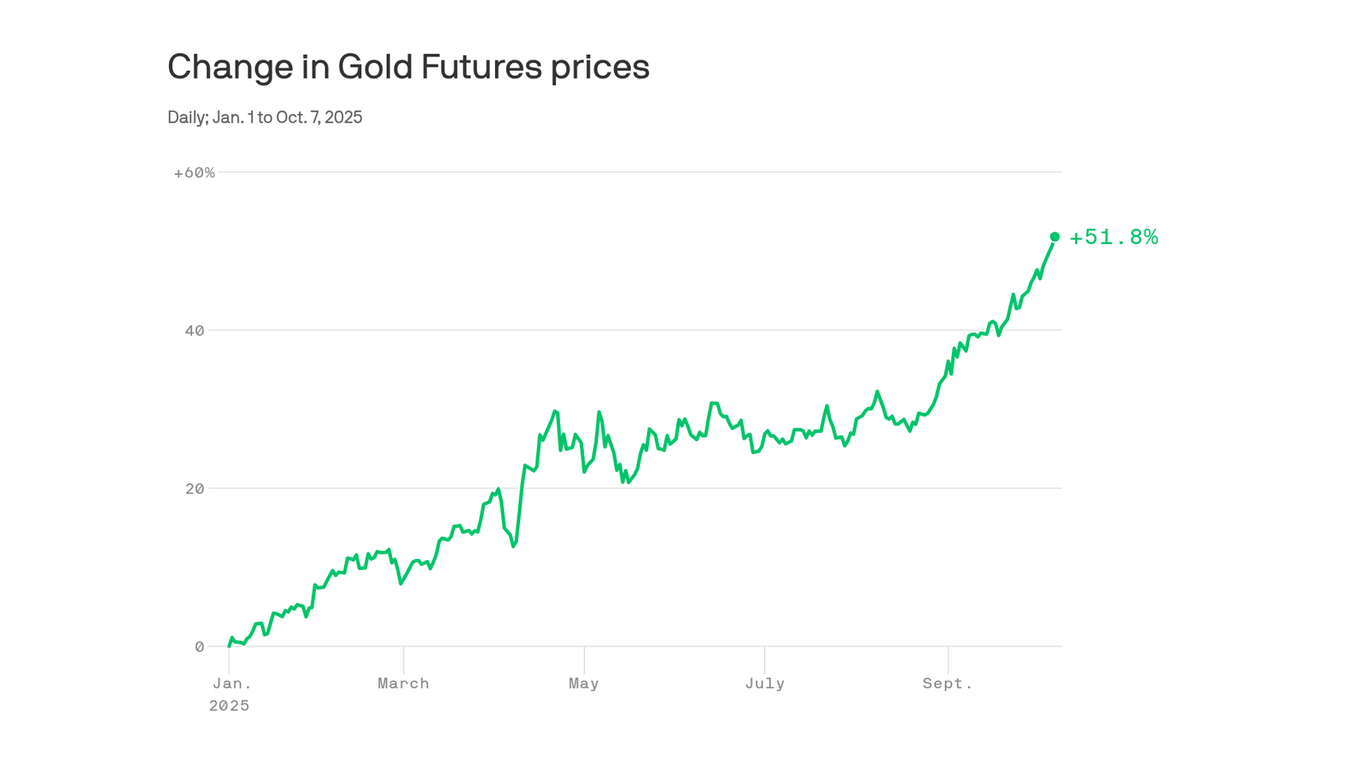

3 months agoTop analyst says China is playing a 'key role' in the price of gold going through the roof, and he's got the data to prove it | Fortune

China's broad-based demand—central bank buying, arbitrage, household safe-haven purchases—is driving gold to record highs, outpacing the U.S. dollar as reserve asset.

[ Load more ]