#global-markets

#global-markets

[ follow ]

#tariffs #trade-war #us-economy #oil-prices #stock-market #trade-policy #iran #federal-reserve #economy

fromwww.aljazeera.com

6 days agoGold surges past $5,500 amid Iran tensions, weakening US dollar

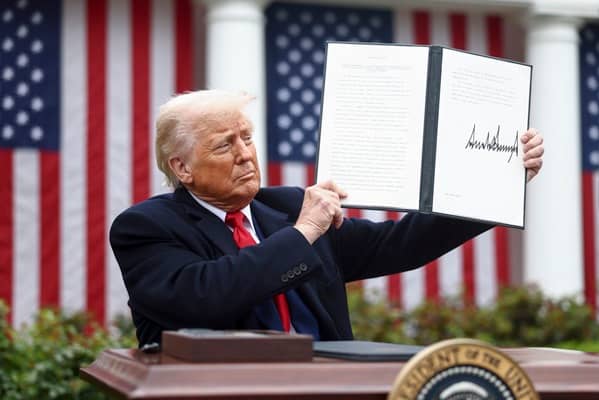

Gold soars past $5,500 an ounce as US President Donald Trump renews threats against Iran. Gold prices have set a new record amid United States President Donald Trump's threats of military action against Iran and the weakness of the US dollar. Bullion surged past $5,500 an ounce on Thursday, extending an extraordinary rally that has seen the precious metal gain more than 20 percent in value since the start of the year.

US politics

fromLondon Business News | Londonlovesbusiness.com

3 weeks agoGlobal markets enter 2026 at a crossroads - London Business News | Londonlovesbusiness.com

Markets are operating in a fragmented geopolitical environment where security concerns increasingly shape trade, investment, and technology policy. Geopolitical tensions, supply chains disruptions, and intense competition in areas such as artificial intelligence are influencing where capital flows and how risks are priced. Although US growth remains relatively strong, it exists alongside ongoing geopolitical uncertainty, stubborn services inflation, and uneven global policy direction.

World news

Business

fromwww.theguardian.com

2 months agoStock market sell-off continues, as Google boss warns no company immune' if AI bubble bursts business live

Global markets fall for a fourth day as technology valuation concerns, AI spending, rising debt and interest-rate uncertainty weigh on stocks, currencies and crypto.

fromLondon Business News | Londonlovesbusiness.com

2 months agoUK budget may not see income tax hike - London Business News | Londonlovesbusiness.com

Asian markets closed out the week on a negative footing, as the tech-sector rout from Wall Street spilled across the globe. Meanwhile, a raft of concerning data points out of China saw weak retail sales, industrial production, and home price figures. This had a particular impact on tech-focused consumer firms such as Alibaba and JD.com. The weakness in both consumer and business indicators signalled a need to be cautious in the region.

World news

fromwww.theguardian.com

2 months agoGlobal markets fall after tech sell-off and fears over Chinese economy

Global markets have fallen after a tech sell-off that fuelled Wall Street's worst day in a month and weak economic data in China showing an unprecedented slump in investment. Japan's tech-heavy Nikkei fell 1.8% on Friday, South Korea's Kospi plunged 2.6% and there was a 1.5% fall in Australia, after a torrid day on Wall Street as Nvidia and other tech companies tumbled over valuation concerns.

Business

fromwww.theguardian.com

3 months agoGlobal markets fall and gold hits record high amid jitters over US banks

Global stock markets fell sharply and gold hit a record high after two US regional banks said they had been exposed to millions of dollars of bad loans and alleged fraud. Signs of credit stress rattled markets across Europe and Asia. In London the FTSE 100 fell 1.5%, Germany's Dax fell 2%, the Ibex in Spain was off 0.8% and France's Cac 40 dropped 1.5%, before recovering some ground.

World news

World news

fromwww.theguardian.com

3 months agoUS treasury secretary accuses Beijing of trying to damage global economy, as US and China roll out tit-for-tat port fees business live

China's rare-earth export controls prompted US accusations of economic sabotage, rattling global markets and cryptocurrencies and threatening to overshadow IMF and World Bank meetings.

fromFortune

3 months agoOpenAI study suggests AI may be about to eclipse human expertise in real-world tasks | Fortune

Rarely does a 29-page scholarly paper merit the attention of top-level executives, but every business leader should be familiar with a recent study from OpenAI. It's the best description yet of how AI can handle real-world tasks, showing which AI models are excelling, and hinting at what it all means for humans in the years ahead. The paper can be heavy going, but you can get a masterful summary from our AI Editor, Jeremy Kahn.

Artificial intelligence

Business

fromBusiness Matters

4 months agoInvesting in 2026: An Outlook by Orb Strategies Experts

Investors should expect differentiated opportunities in 2026 across technology, greener energy, emerging markets, and real assets, balancing higher risk with diversification for potential long-term growth.

Business

fromFortune

5 months agoGlobal selloff in the markets: Investors got a look at a world where the dollar isn't a reliable reserve currency and decided they didn't like it

Political moves to remove a Fed governor and threaten China tariffs triggered global market and bond selloffs, raising fears about Fed independence and the dollar.

US politics

fromFortune

7 months agoThe S&P 500 has retaken all-time highs. Here's how much European and Chinese stocks raced ahead while U.S. markets regained lost ground

U.S. stocks have rebounded to pre-crisis levels after an initial crash caused by tariffs, reflecting shifting investor sentiment.

Global markets are experiencing a shift as investors move away from U.S. stocks to explore opportunities in Europe and China.

London startup

fromLondon Business News | Londonlovesbusiness.com

8 months agoDiversifying wealth: Real estate as a hedge for London entrepreneurs - London Business News | Londonlovesbusiness.com

London entrepreneurs must adopt resilient investment strategies to shield capital from economic challenges in 2025.

Cryptocurrency

fromLondon Business News | Londonlovesbusiness.com

9 months agoBitcoin rises slightly as tensions appear to ease, but upside trend signs weak - London Business News | Londonlovesbusiness.com

Bitcoin and other cryptocurrencies are showing gains amid trade negotiations, though concerns persist about escalating tensions with China.

UK politics

fromwww.theguardian.com

9 months agoDo you yearn to hear Starmer condemn Trump? If so, you're going to be disappointed | Andrew Rawnsley

Assessing Donald Trump's actions yields more confusion than clarity, suggesting that speculation around his decisions often leads to instability rather than understanding.

[ Load more ]